Odoo ACCOUNTING Software: Automate Finance & Invoicing

Accounting, Financial Close and Tax Management.

"Streamline reconciliation, consolidation processes &

close faster. Transform your general ledger, optimize AR, automate AP and generate

accurate reports."

Odoo Accounting: Smarter, Faster, and More Integrated

(Receivable, Billing and Revenue Management)

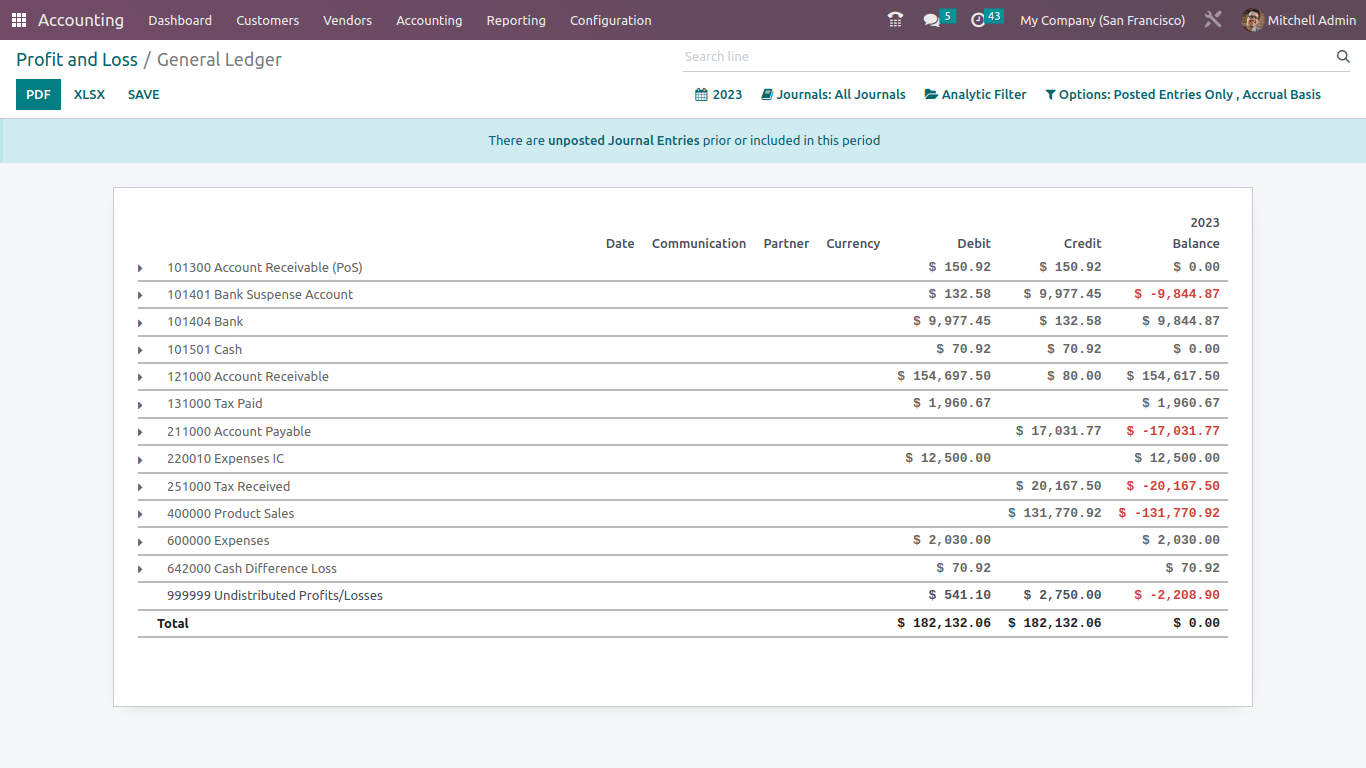

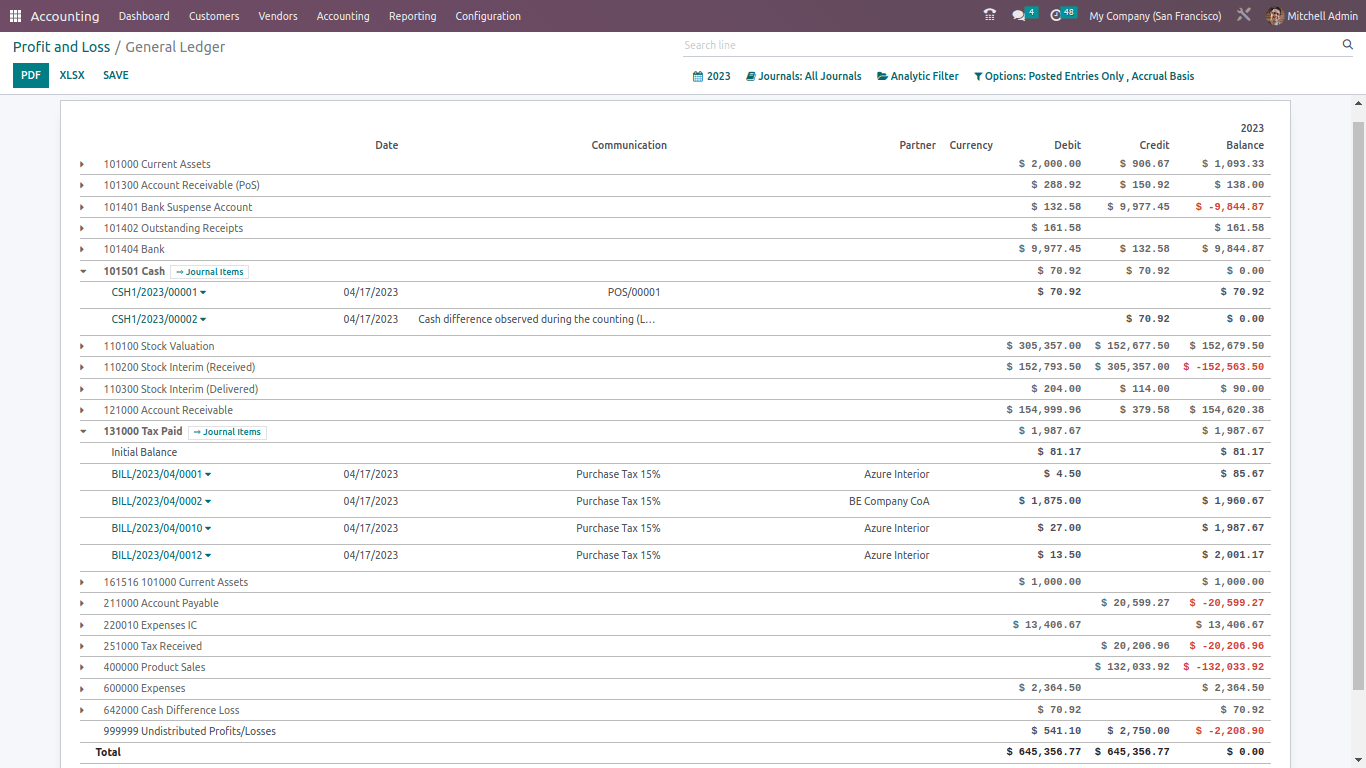

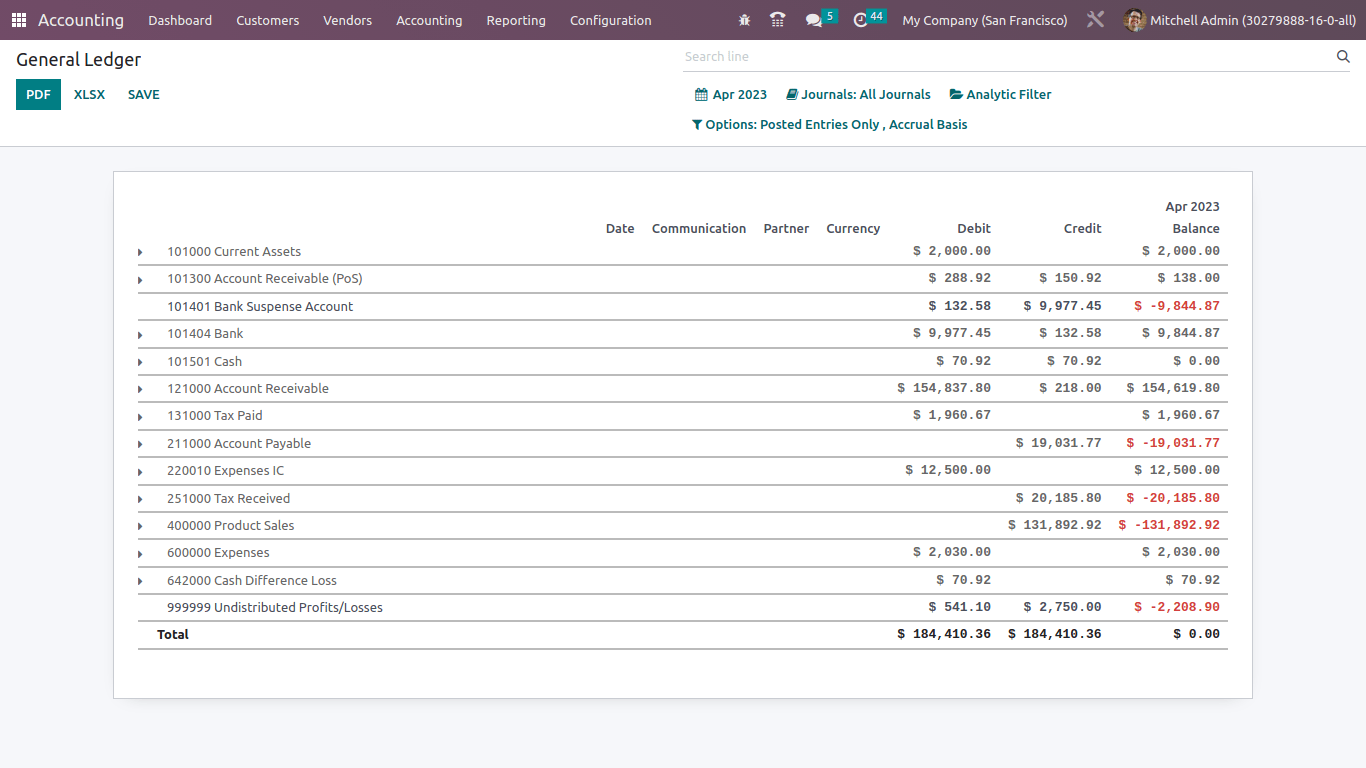

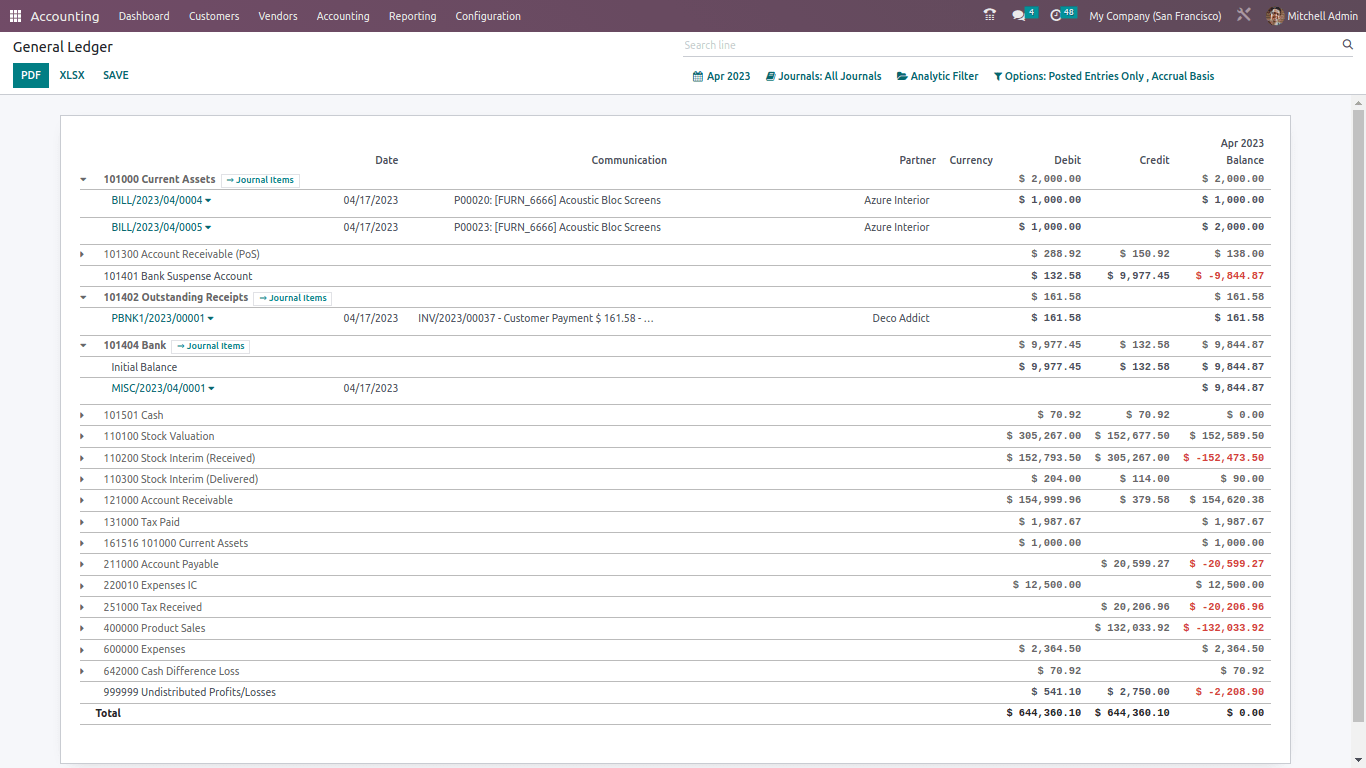

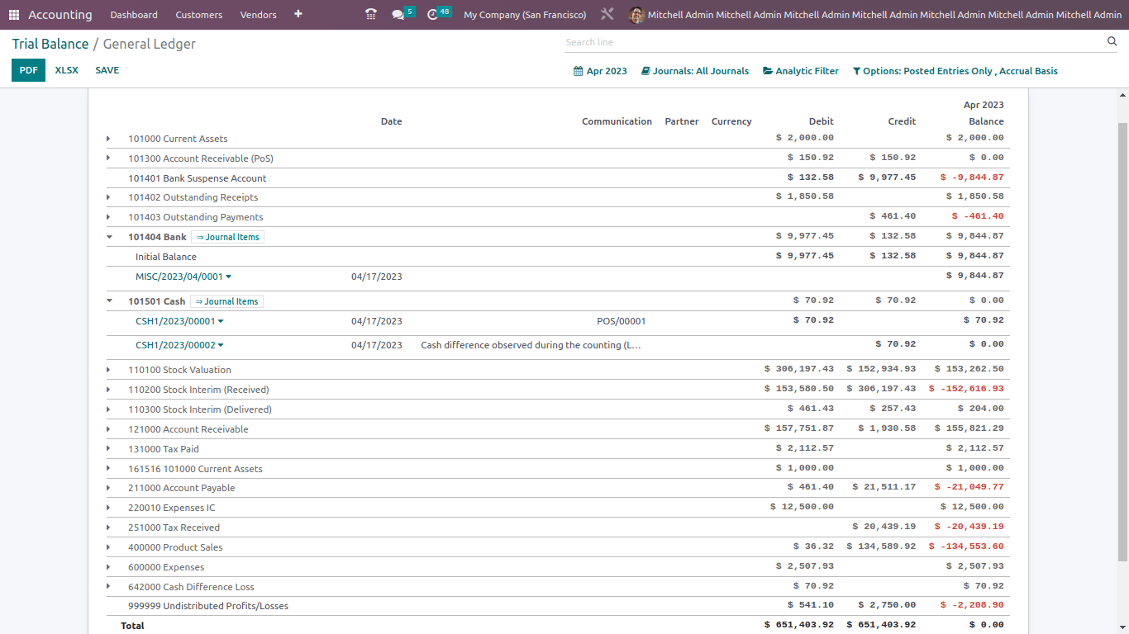

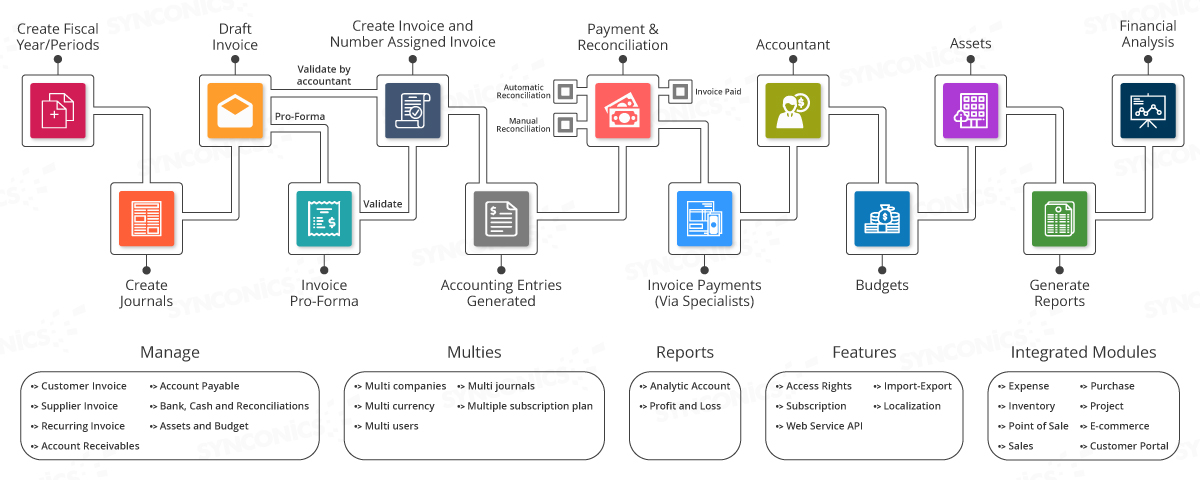

Odoo uses the rules of the double-entry bookkeeping system: all journal entries are automatically balanced (sum of debits = sum of credits)

The Accounting module in Odoo ERP is designed to efficiently manage a company’s financial operations by integrating seamlessly with other modules such as Sales, Purchasing, Inventory, and Payroll to automate financial workflows.

It simplifies the process of recording transactions by automatically creating all the behind-the-scenes journal entries for each accounting transaction, including customer invoices, point of sale orders, expenses, inventory moves, and more.

- Managing payables and receivables

- Collecting taxes

- Closing the books & enables timely

- Accurate reports

- Greater control of financial assets

Why Businesses Choose Odoo for Financial Management?

Managing finances is one of the most important parts of running a business. Odoo is a popular choice for financial management because it helps companies handle money easily and efficiently.

All-in-One Financial Solution

Easy to Use

Real-Time Financial Insights

Integrates with Other Business Apps

Automates Financial Tasks

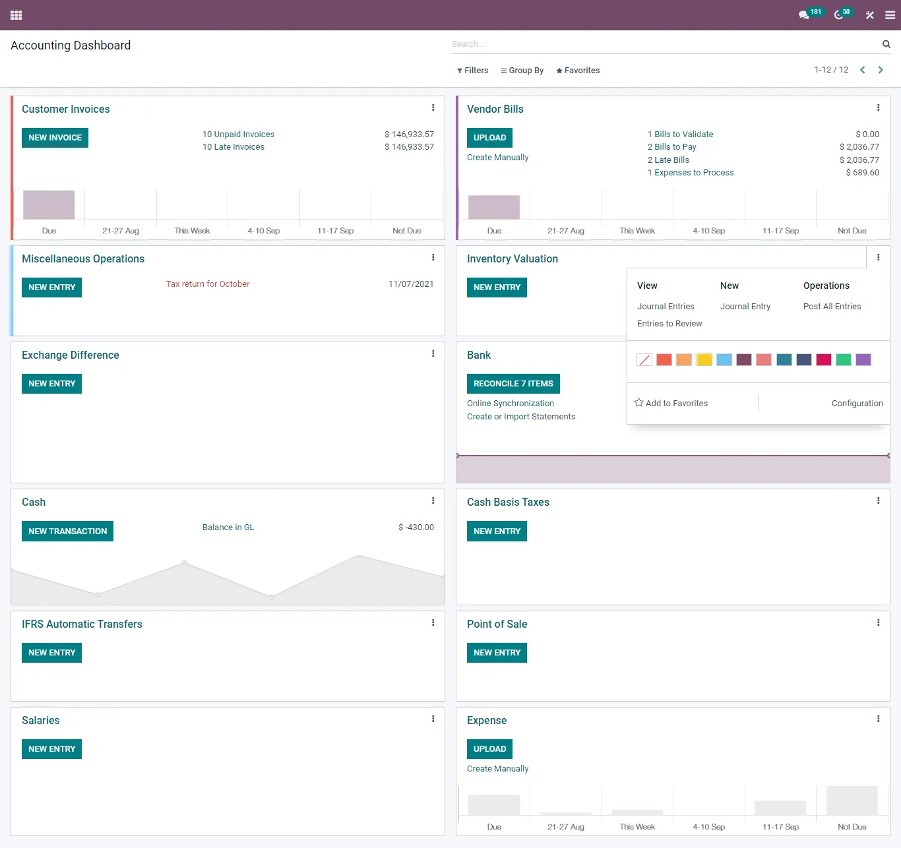

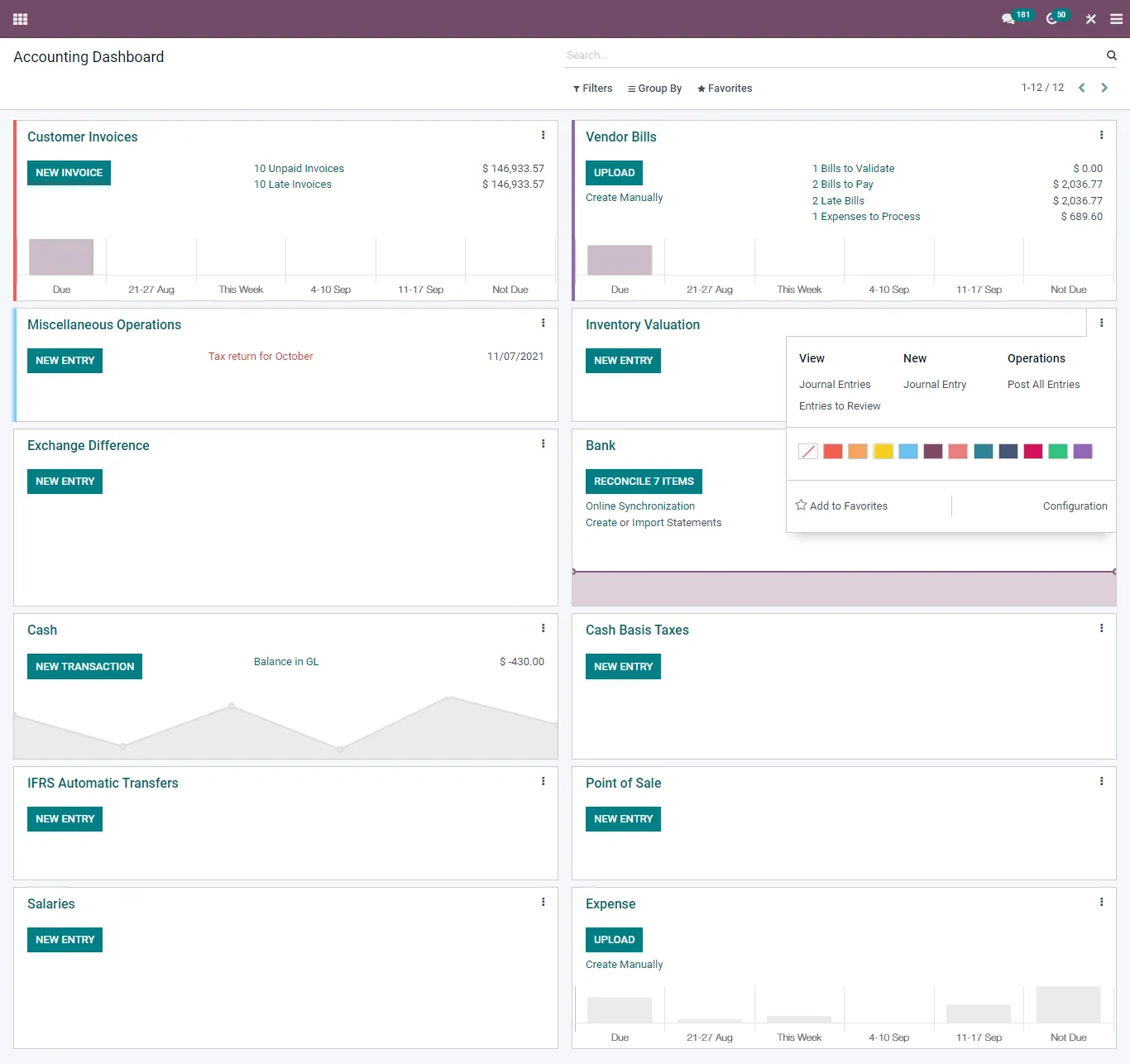

Accounting Dashboard

"Accounting All in One Place"

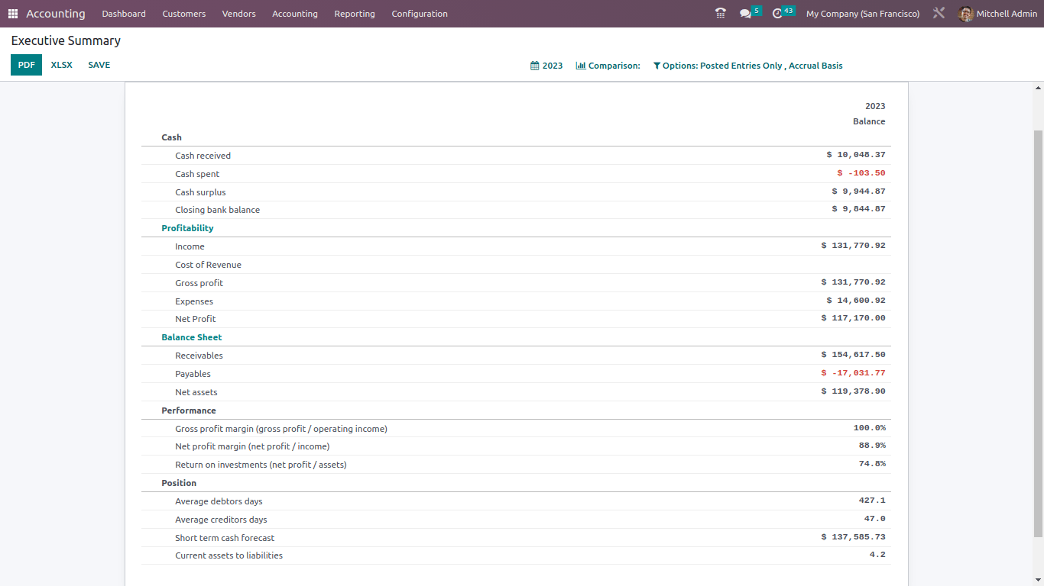

Gain real-time insights into numerous financial metrics, such as profitability ratios, inventory margins, liabilities, fixed assets, taxes, and cash positions. Ensure compliance with accounting standards, government regulations, tax codes, and internal policies.

Create your own accounting dashboard by assembling custom reports. Generate reports for any time period, comparing time periods. Get dynamic calculation of certain fields e.g. YTD earning. Share filters and dashboards across teams.

Request a Free Odoo Accounting Demo and See How SMEs Simplify Financial Management.

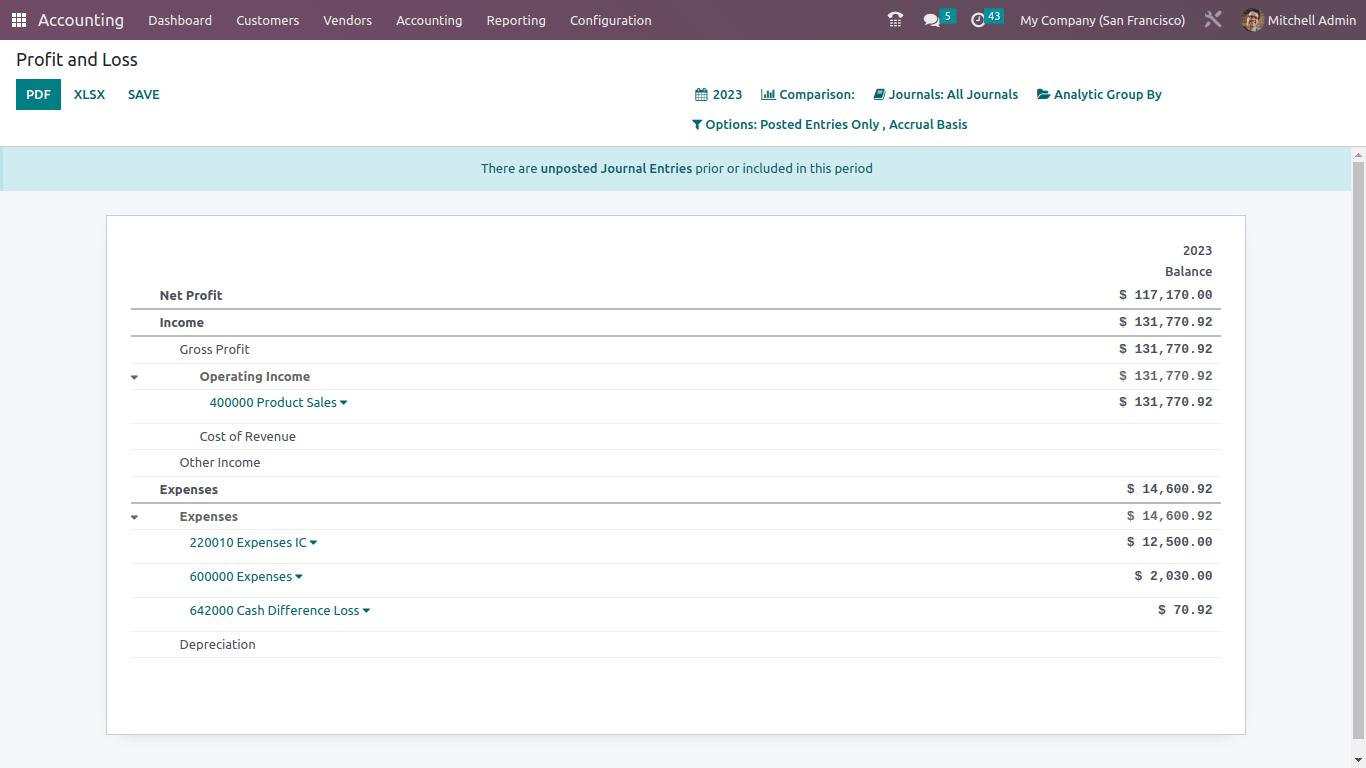

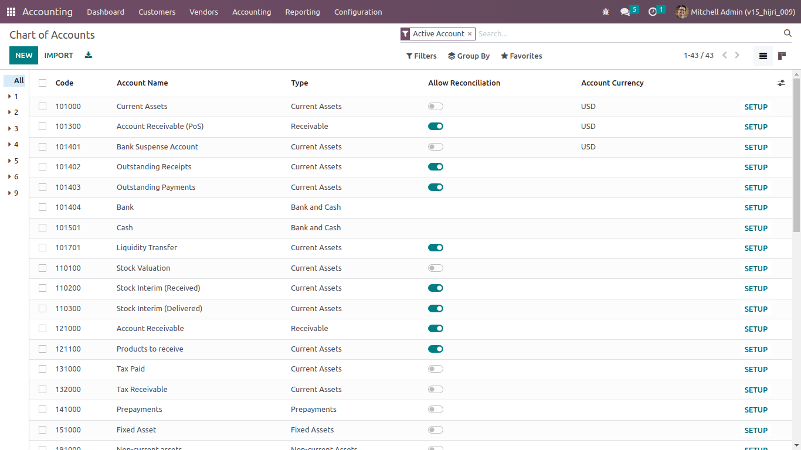

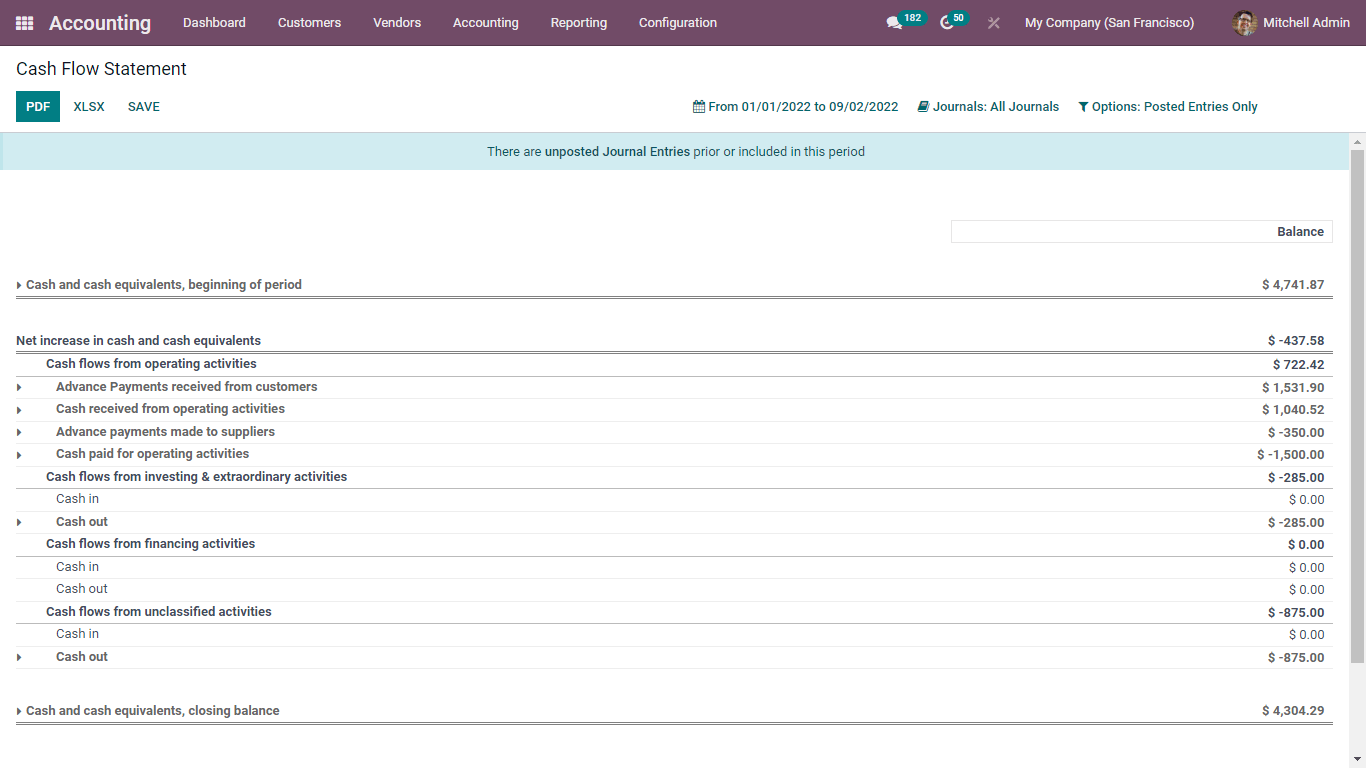

Different Types Of Financial Reports In Odoo Accounting

Easily create your earnings report, balance sheet or cash flow statements. Improve data quality and accelerate financial close processes. You can annotate every accounting reports to print them and report to your adviser. Export to XLS to manage extra analysis. Drill down in the reports to see more details (payments, invoices, journal items, etc.). Compare values with another period. Choose how many periods you want to compare the chosen time period with. You can choose up to 12 periods back from the date of the report if you don’t want to use the default Previous 1 Period option.

Key Benefits Of Odoo Accounting Software

Odoo accounting software seamlessly integrates with all the other

pieces of the suite, including financial management capabilities, inventory and order

management, HR, customer management, ecommerce and more. Now you can stop worrying about

your business systems and concentrate on growth.

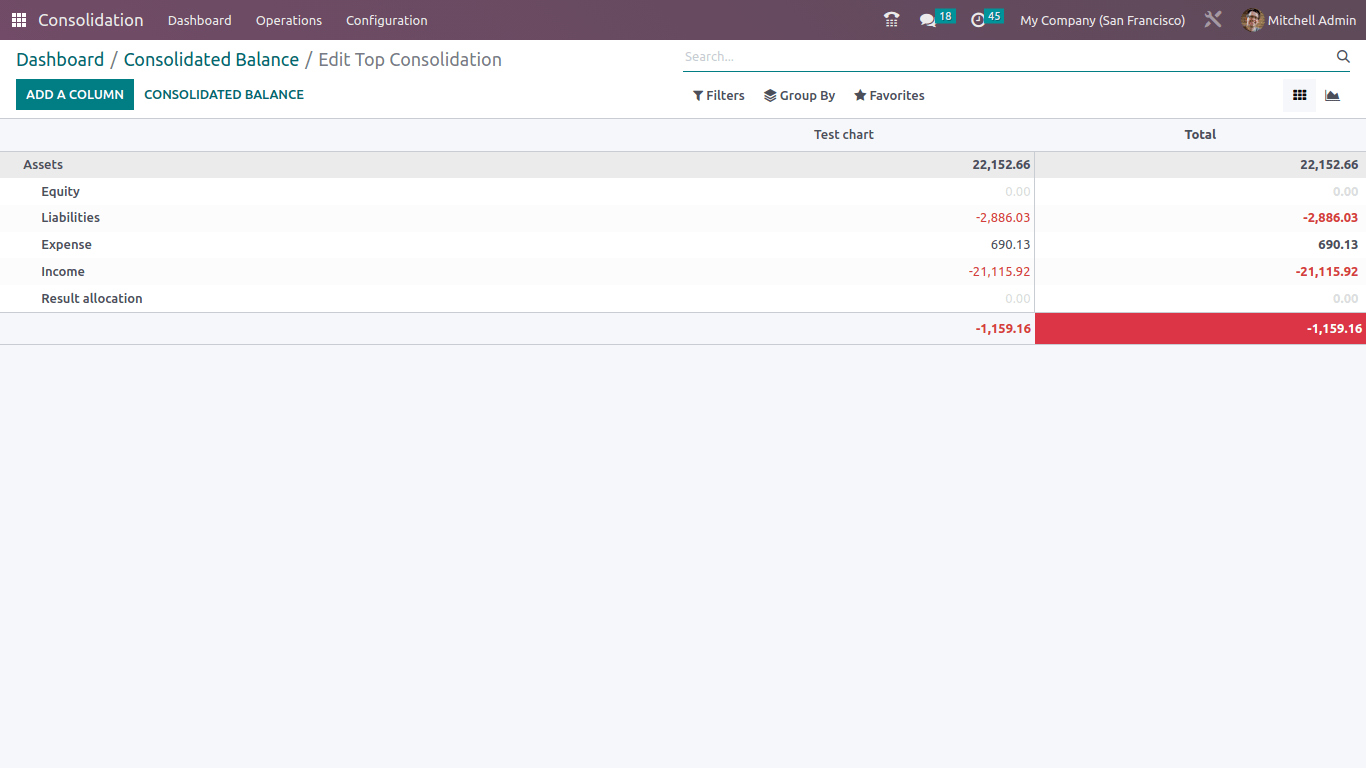

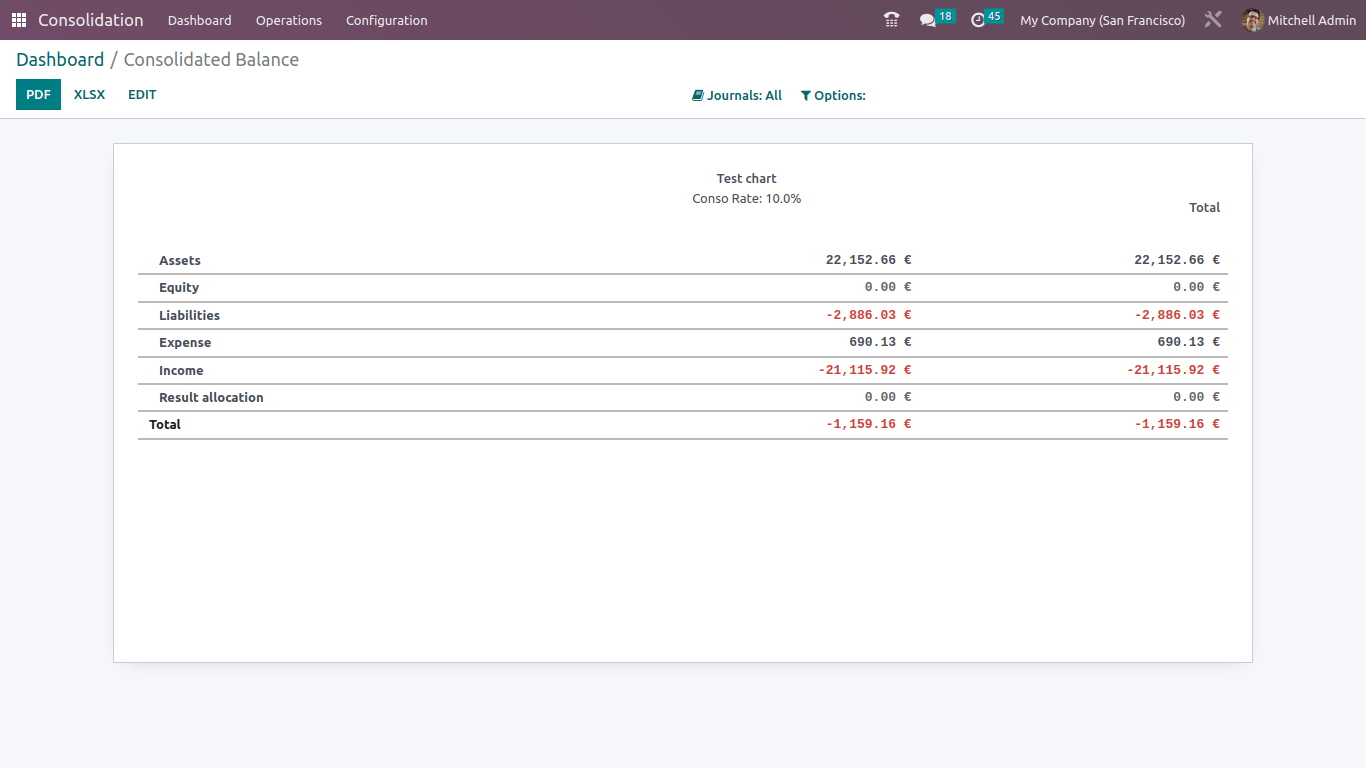

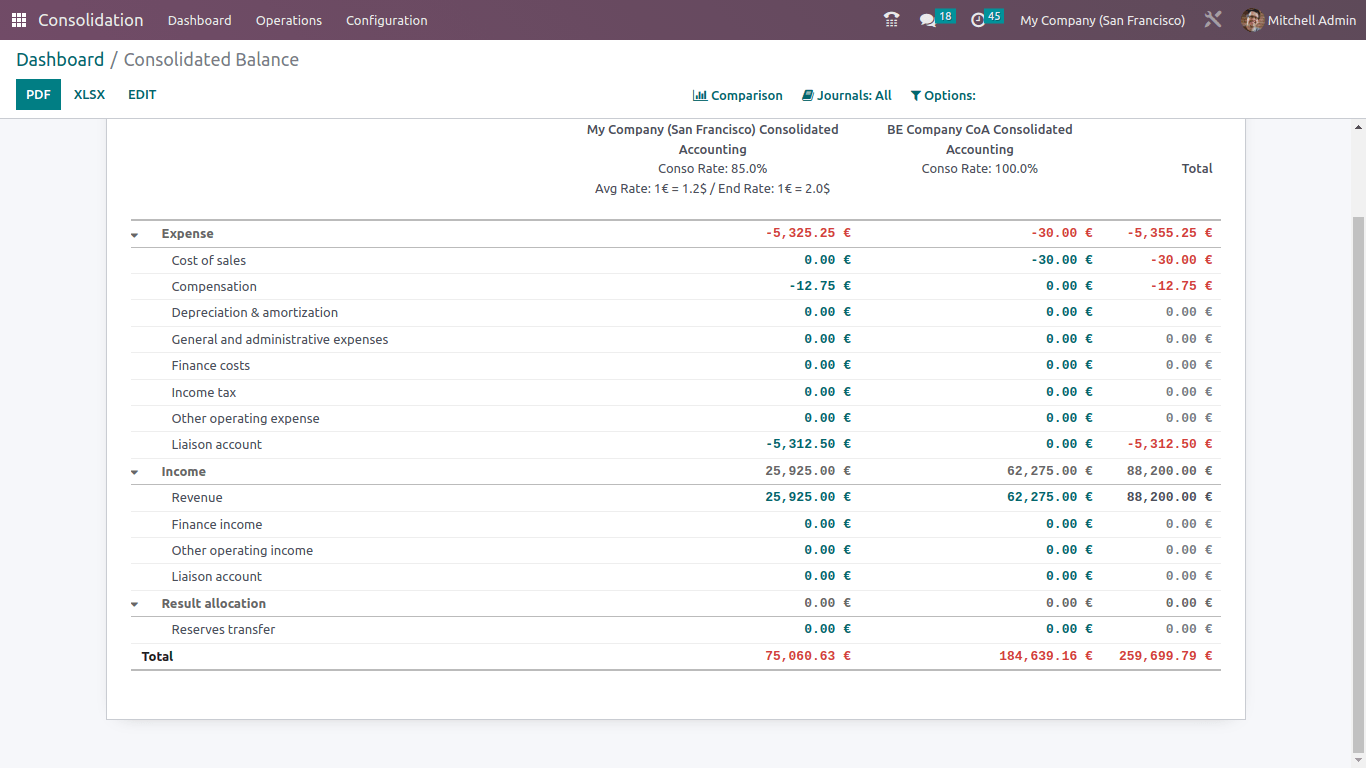

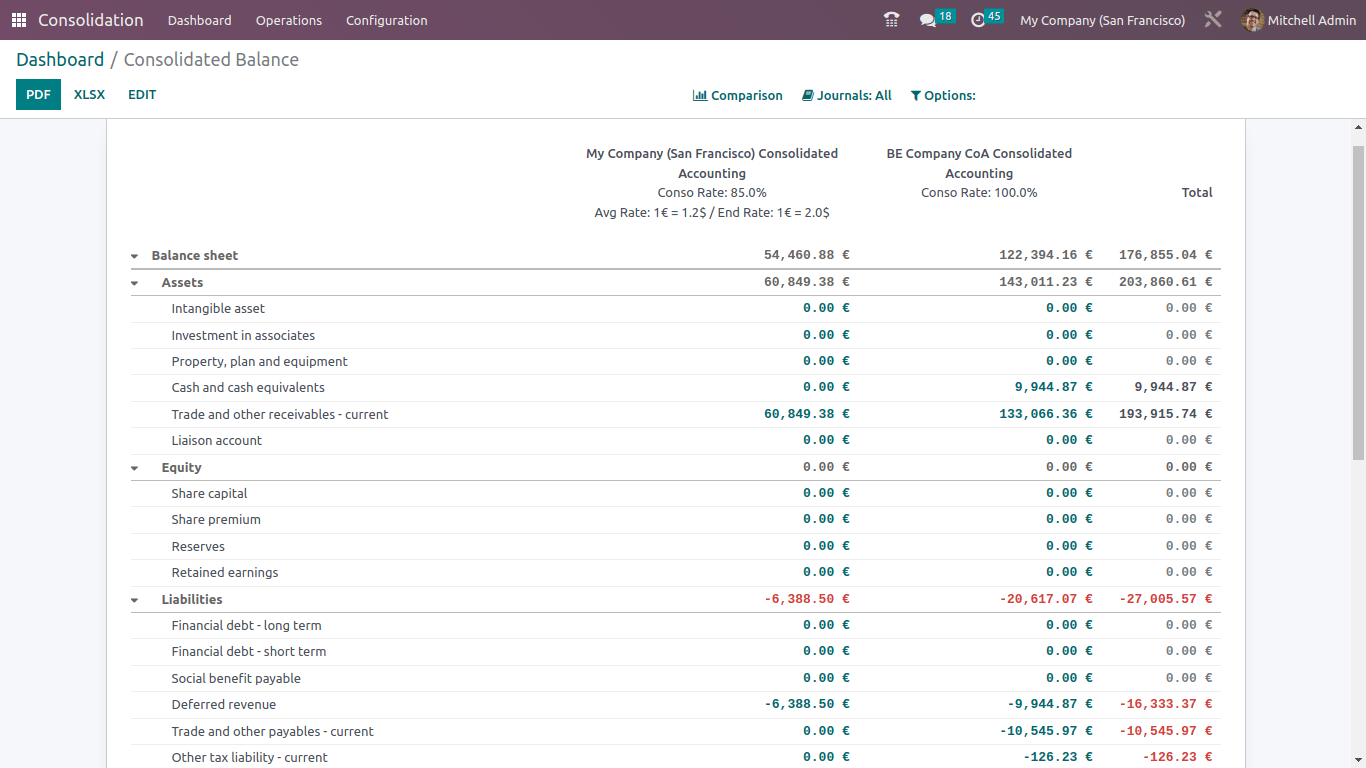

Multis

Manage everything from one platform with automated business rules, real-time currency updates, and subsidiary integration for instant consolidated reports.

Organize data across multiple journals and assign custom access rights to unlimited users.

Features:

-

Multi-currency

-

Multi-company

-

Multi-user

-

Multi-journal

Smart

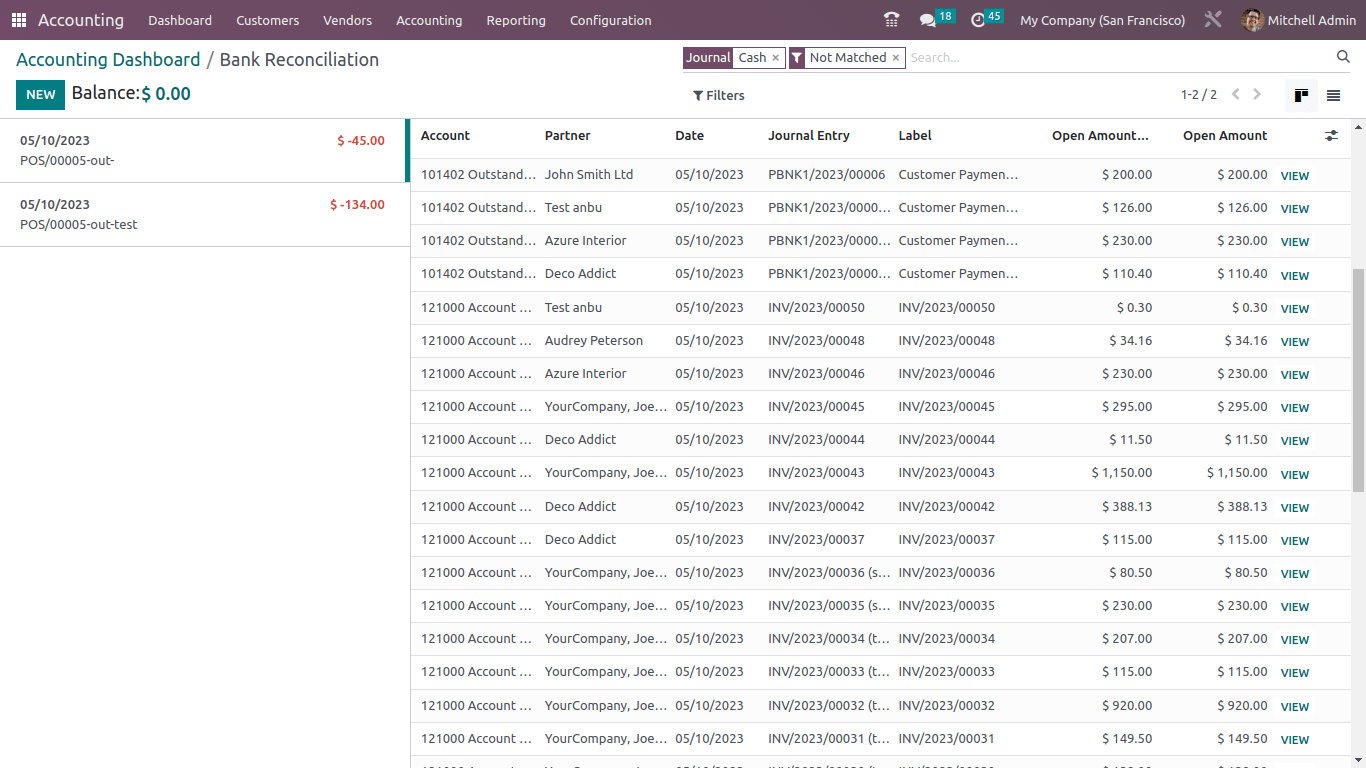

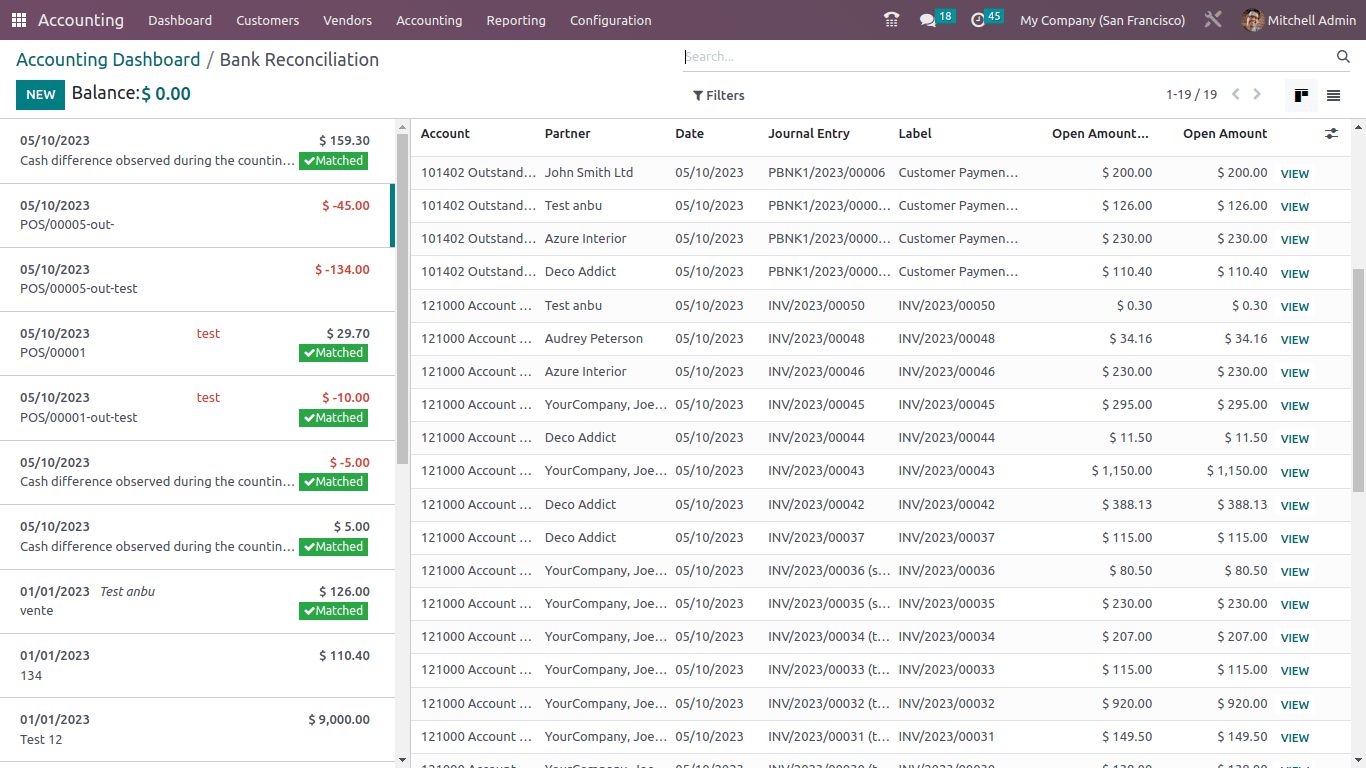

Reconciliation

Automatically get reconciliation suggestions, add journal items instantly, and search with ease.

Handle manual reconciliations for both open and paid invoices, with partial or full matches from invoices or bank statements.

Fiscal Localization

Country-specific modules that pre-configure taxes, fiscal positions, chart of accounts, and legal statements.

Additional features, like certificate setup, are included to meet local accounting requirements.

Comparison

Easily compare reports and journal entries in Odoo to make better decisions.

Compare by previous period, same period, last year, or customize as needed.

Subscription

Easily manage subscriptions, templates, recurring fees, and contracts.

Automate invoices, payments, and renewal reminders.

Customer Portal

Your customers can change their plans, order upgrades or

downgrades / unsubscribe through the customer portal. (Based on your

configuration).

Refunds

Quickly create and track refunds, unify them on balance sheets, and manage everything from a dedicated dashboard.

Batch Payments

Group payments for easier reconciliation and validate them directly from the vendors tab.

Talk to Our Odoo Experts to Find the Right Accounting Solution for Your SME

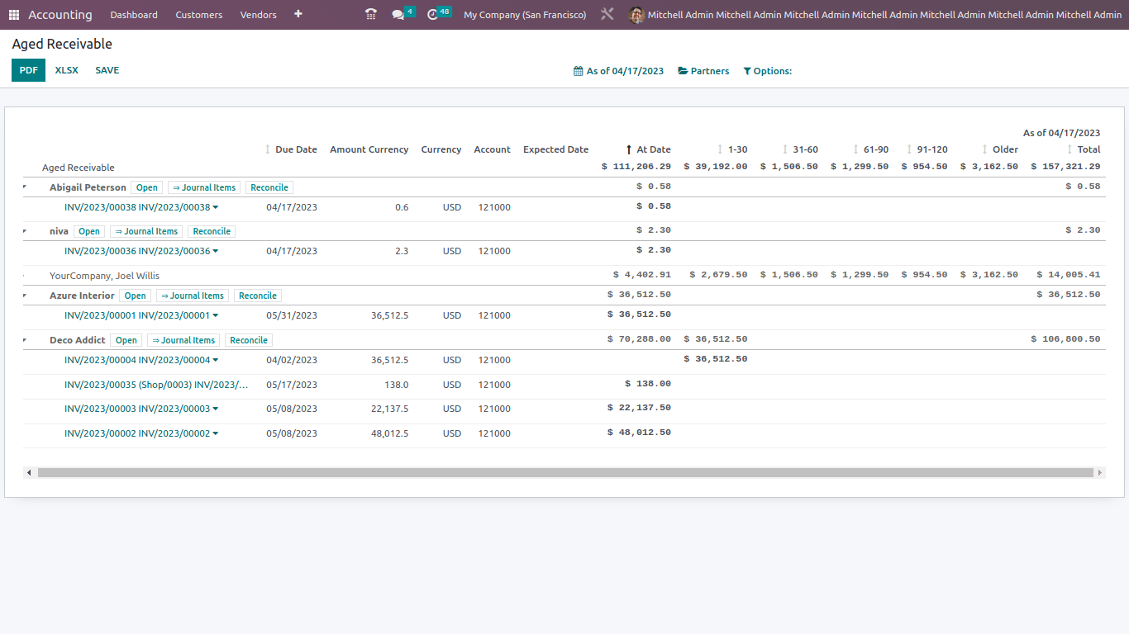

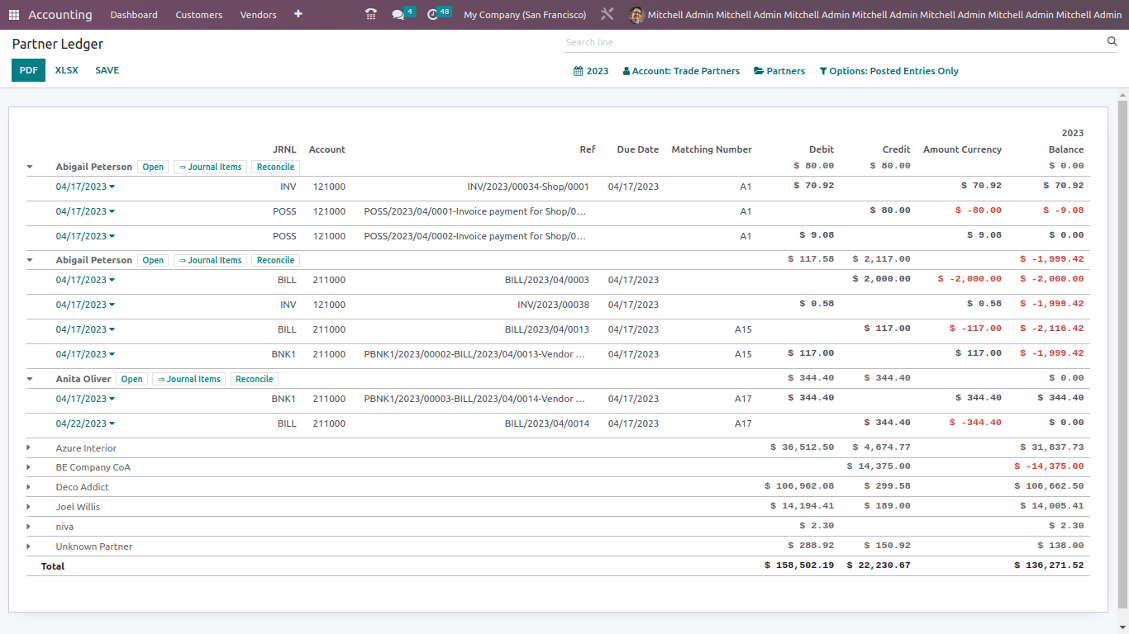

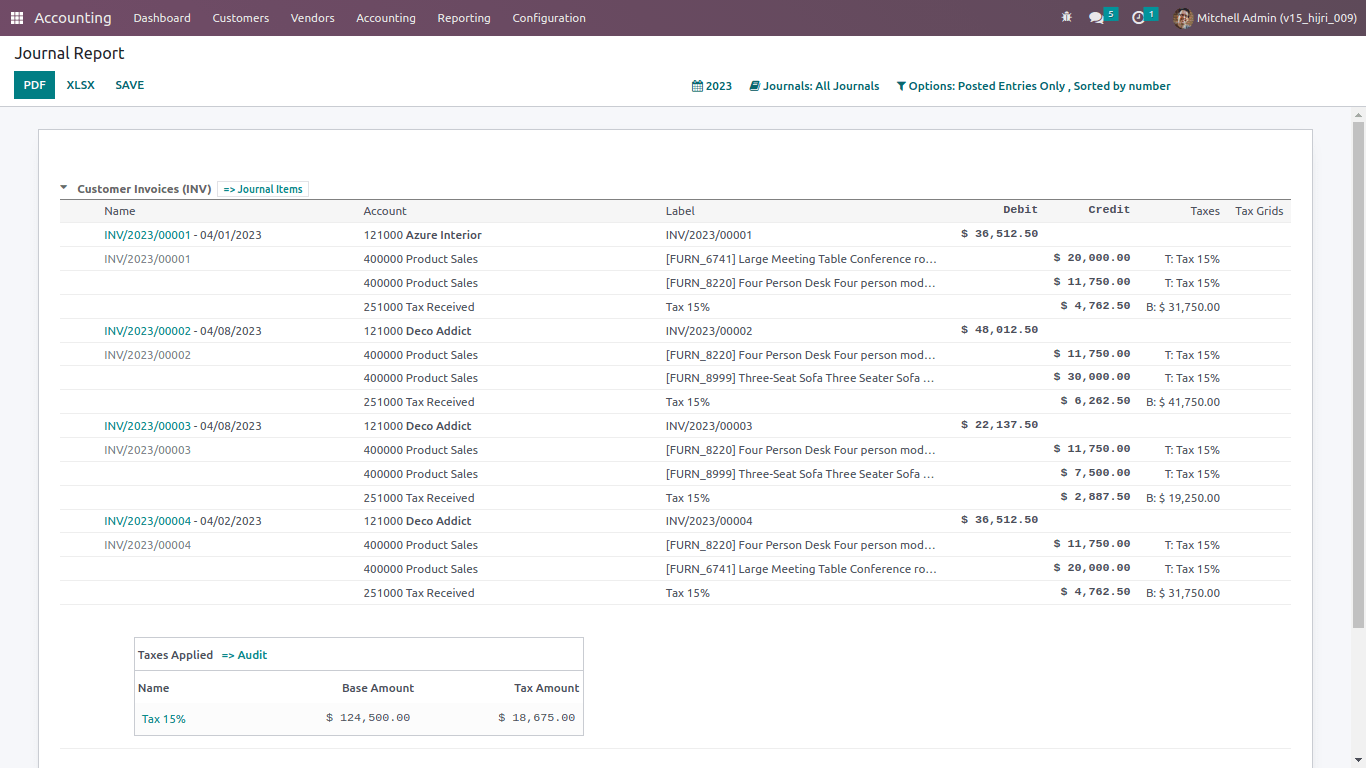

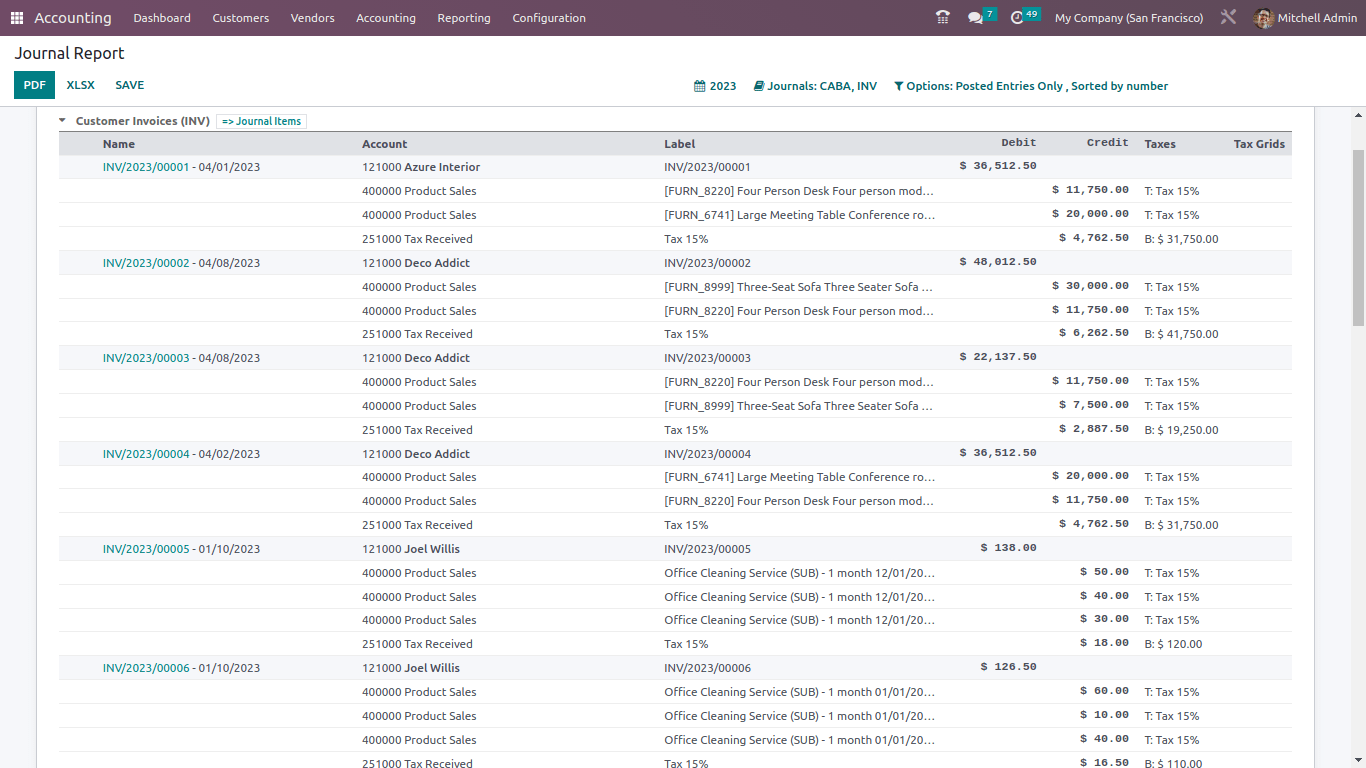

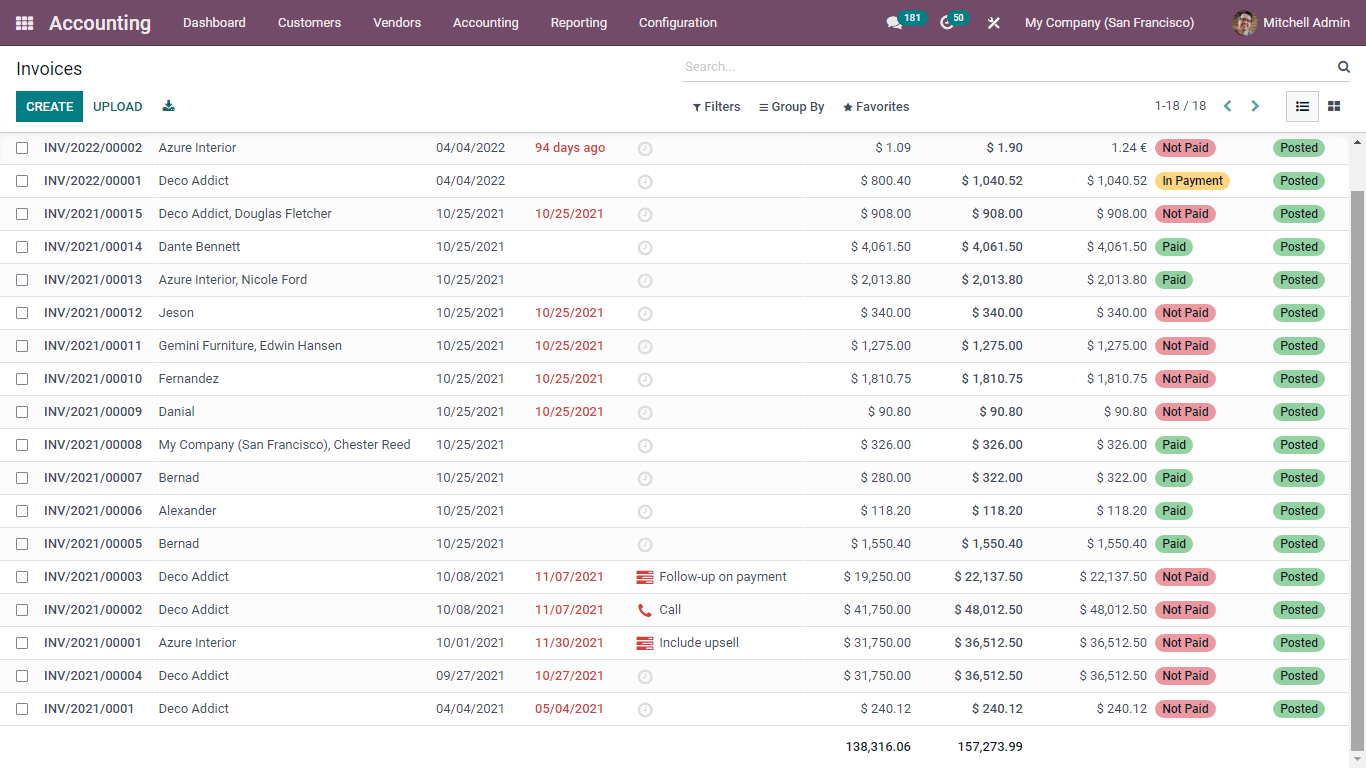

Accounts Receivable In Odoo Accounting

"Optimize Customer Invoice and Customer Payments, accelerate cash flow"

Odoo automates and streamlines every aspect of invoice delivery, payment processing and collections management so you can increase liquidity to fund growth, shorten the credit-to-cash cycle, enhance service levels and seize new investment opportunities as they arise.

Automatically post order transactions to general and AR ledgers, with accurate tax calculations on each invoice, for rapid, precise tax processing and billing.

Enhance the payment experience with innovative subscription-based billing, revenue, and accounts receivables management.

Odoo invoices includes payment terms, multiple taxes, discounts, price lists

Different ways to record a payments

- Draft invoice propositions

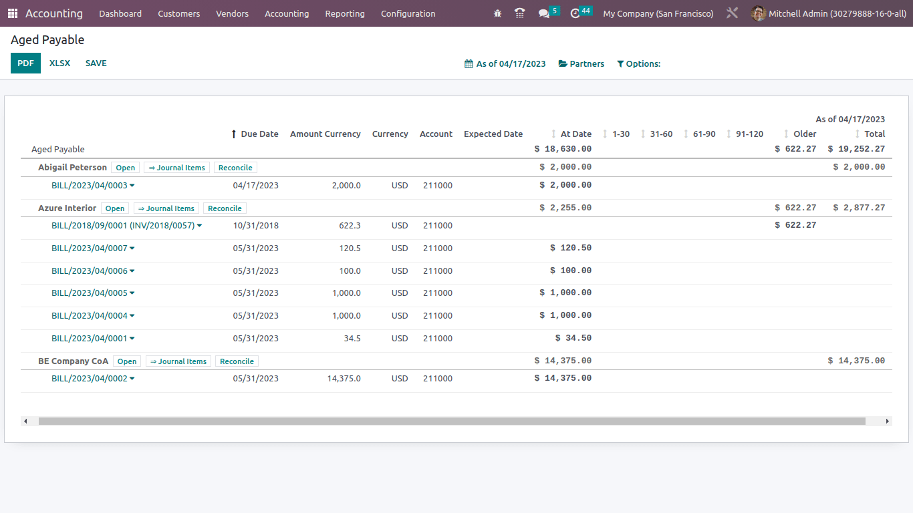

- Aged receivable balance

- Offer cash discounts

- Credit Notes and Refunds

- Payment Terms and Installment Plans

- Credit Card Payments

- Customer Portal

- Cash Rounding

- Deferred Revenues

- Add EPC QR Codes to Invoices

- Invoice Online Payment

- Register customer payments by checks

- Batch Payments: Batch Deposits (checks, cash etc.)

- Batch Payments: SEPA Direct Debit (SDD)

- Follow-up on invoices and get paid faster

Accounts Payable In Odoo Accounting

“Vendor Bills, Vendor Payments & Forecast future bills to pay”

Ensure compliance with internal policies, by automating your

accounts payable processes. Avoid late fees and improve cash flow by taking advantage of

early payment discounts. With Odoo, accounting, sales, operations, purchasing, and other

departments can share information, seamlessly. Manage the entire procure-to-pay process on a

single platform, monitor budgets to prevent overspending, and automate approval workflows

and time payments to preserve cash.

- Advanced Payment Dashboard

- 3 step verification (compare information of Purchase order, Vendor Bill and the receipt)

- Digitized payment of Bills

- Clear and Detail view of Forecast Expenses

- Trace employee expenses (via validation and reimbursement)

- Pay and print checks in few clicks

- Automate Payment to supplier with SEPA based on propositions

- Track deposit tickets in few clicks

- Set up validation steps for payment flows

Get a Free Consultation to See How Odoo Accounting Fits Your Business Needs

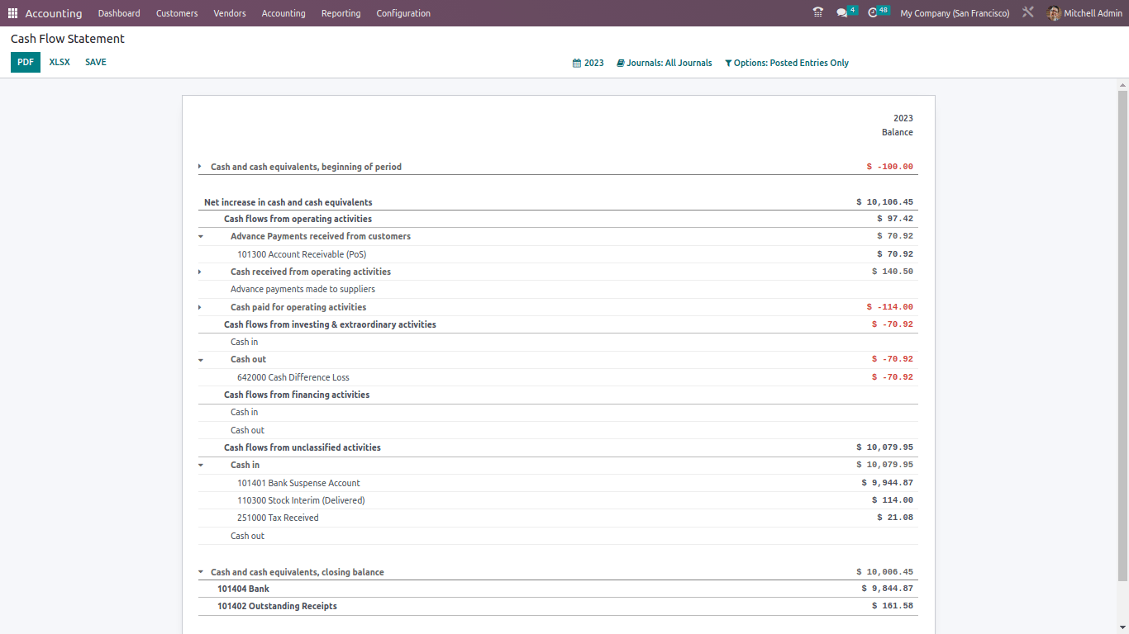

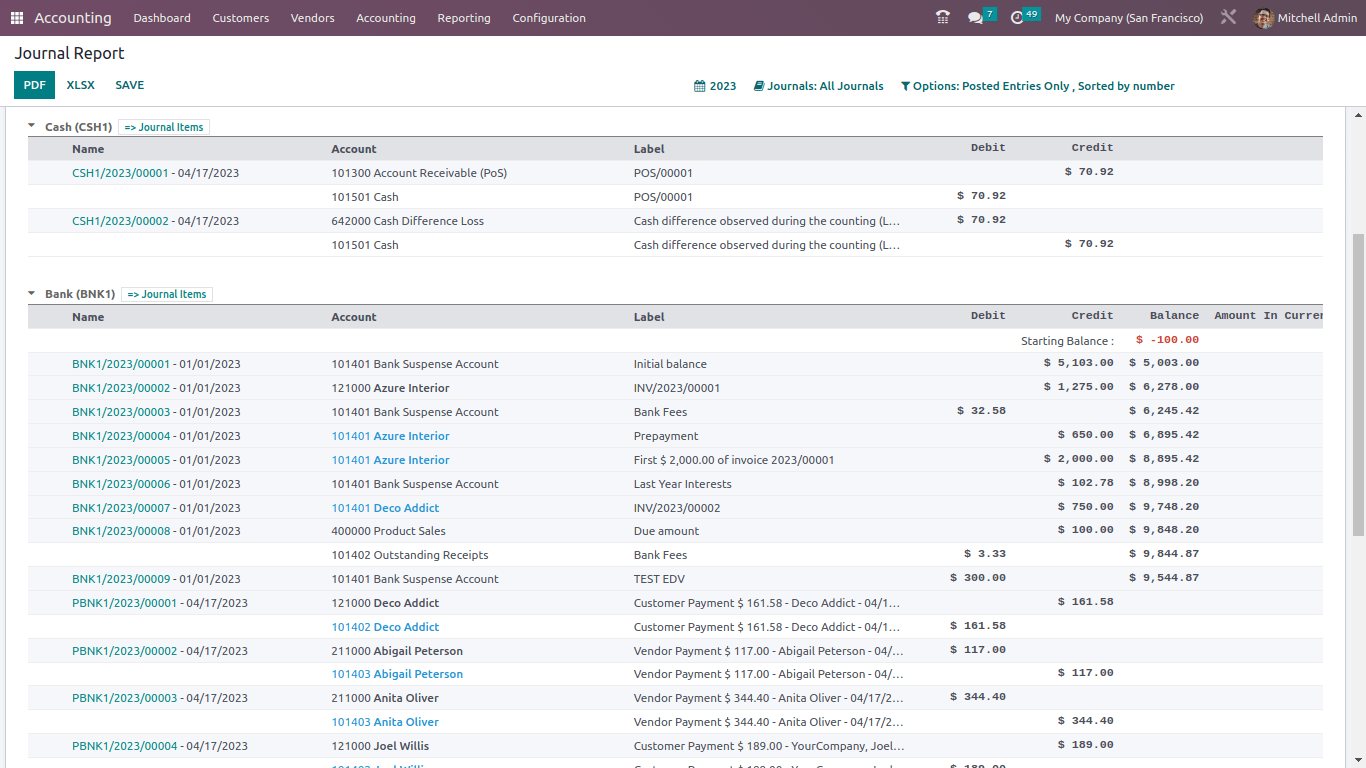

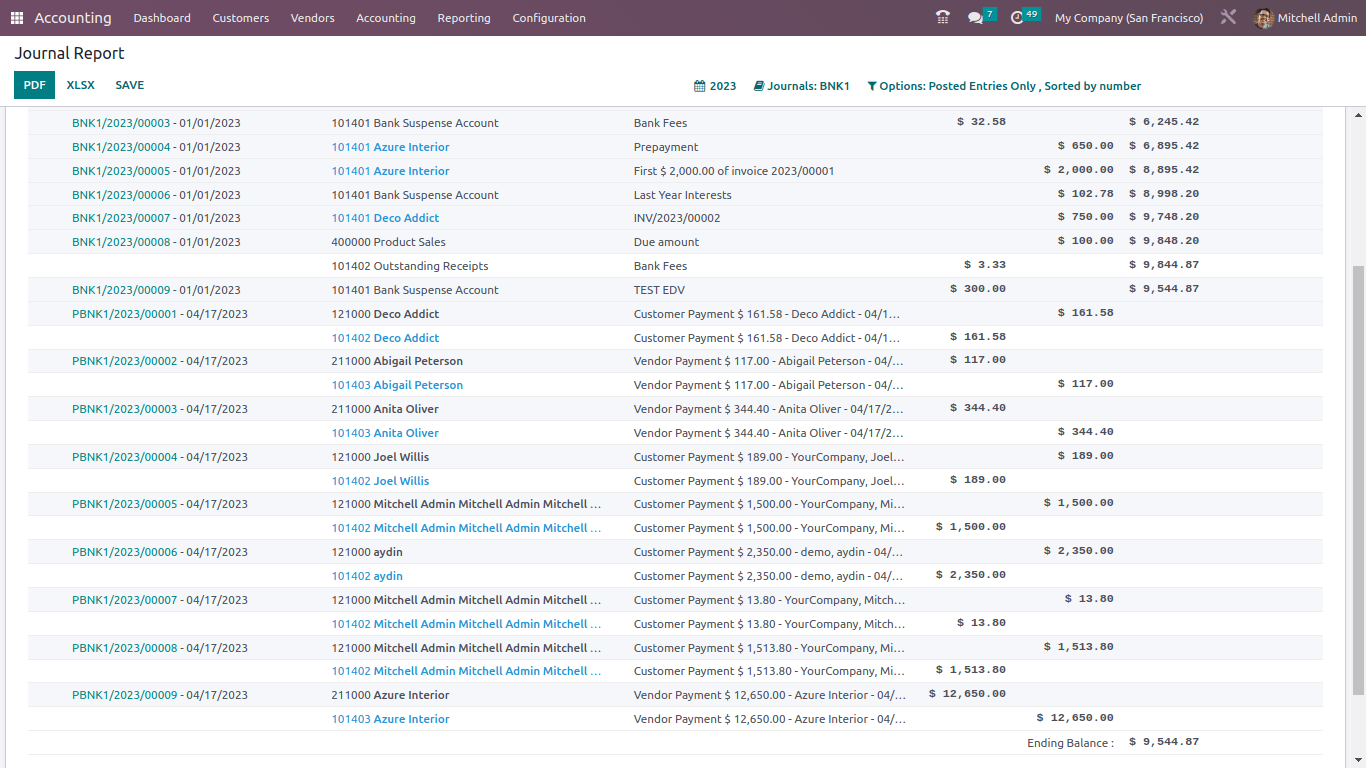

Bank and Cash In Odoo Accounting

“Effortless bank synchronization so that you never miss anything.”

Odoo cash management solution provides real-time access to banks. Accelerates the reconciliation process and boosts the accounting team’s efficiency. Automatic imports provide an accurate picture of your current cash position so that finance has all the insights they need to optimize working capital, forecast cash requirements and deliver accurate reports.

The cash register is a journal to register receiving's and payments transactions. It calculates the total money in and out, computing the total balance.

- Automate bank feeds directly from the bank (with 15,000 bank support)

- Get your bank statements synced with your bank automatically

- Import files easily

- Use of OFX, QIF,CSV or Coda files, to import statements)

- Handle cash registrations (via. track transaction of opening and closing)

- Trace every cash transaction with opening and closing

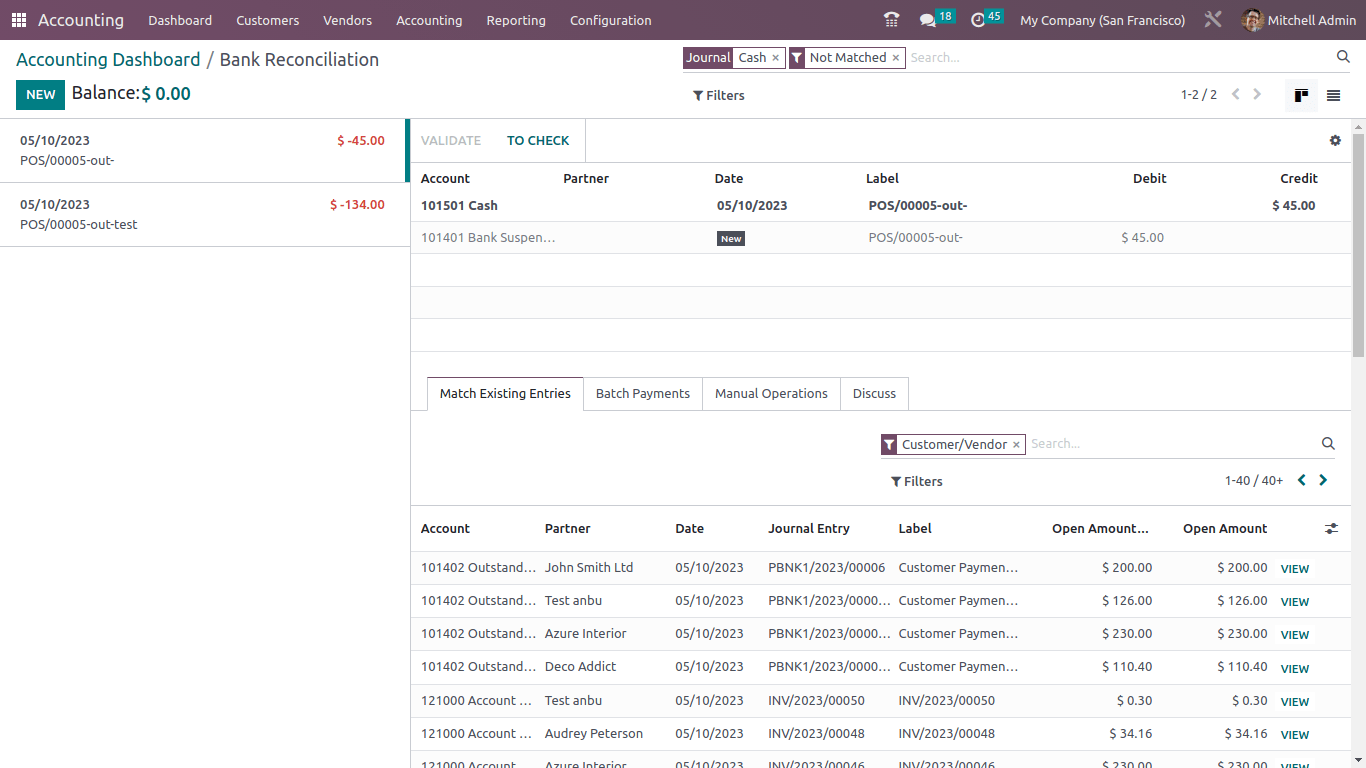

Bank Reconciliation

-

The bank reconciliation screen is now easier to use.

-

Automatic reconciliation models are improved to better recognize transactions.

-

Keyboard shortcuts can now be used in the bank reconciliation view.

-

You can now reconcile draft entries.

-

Automatic moves (like currency exchange or cash basis moves) are created as drafts at the same time as the reconciliation.

-

When you post the original entry, the reconciliation is confirmed automatically.

-

You can fully reconcile or write off items that were only partly reconciled.

Bank statement OCR manual correction

- Odoo Enterprise support only

- Server manage by Odoo company

- Allow custom development

- Install third-party apps

- Integration with Github

Bank transactions with PDF preview

-

Preview attached documents directly in the bank transaction list view whenever a document is linked to a statement.

Recipient Bank Account

- The Recipient Bank Account field on customer invoices is now filled automatically using a better selection process.

- If the customer (partner) has a specific payment method, Odoo will use a related bank account for that payment.

- If no payment method is set, Odoo will choose a company bank account that uses the same currency as the invoice.

- If no matching account is found, Odoo will use the first available bank account.

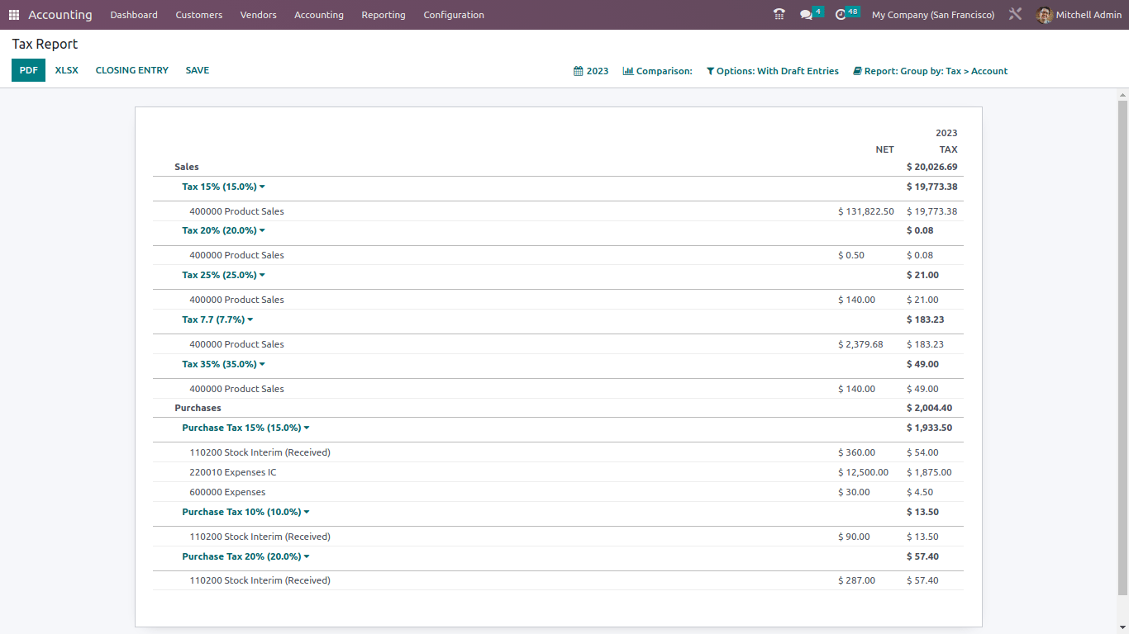

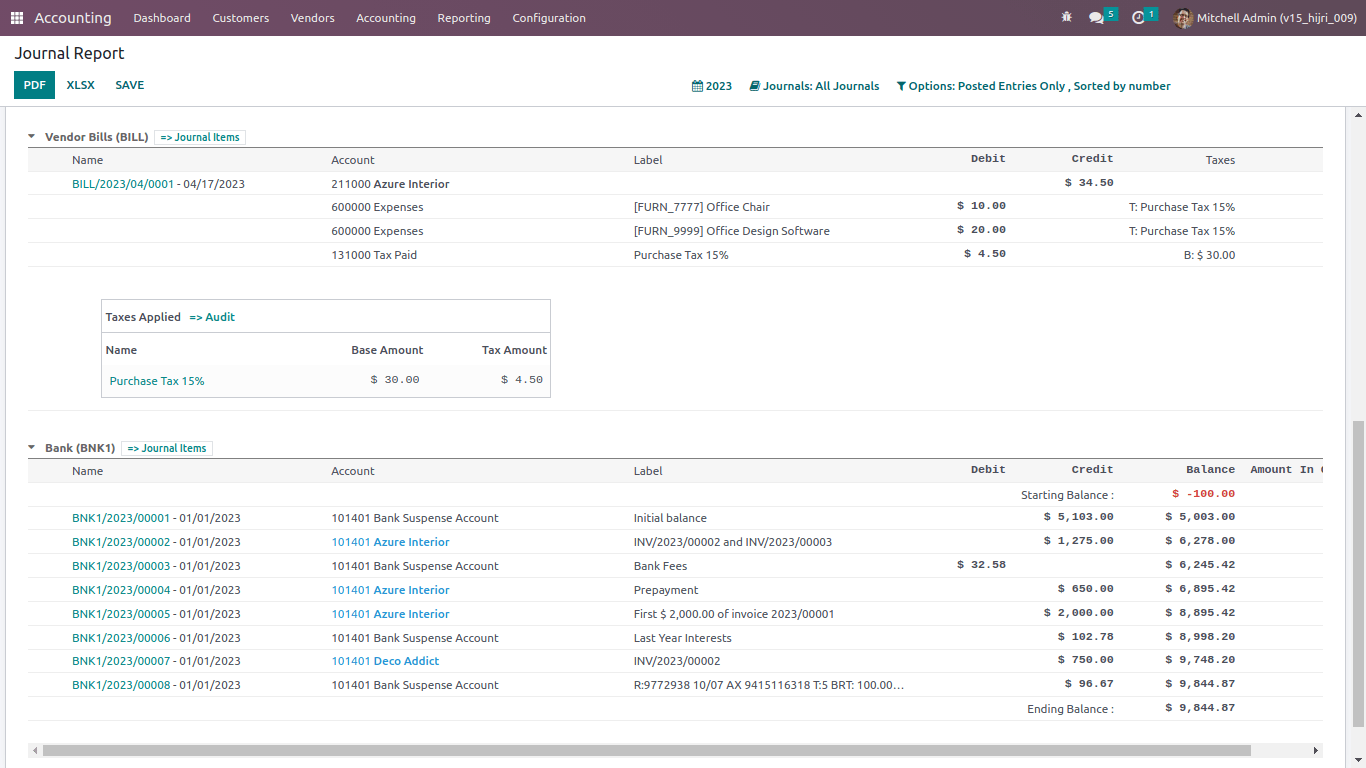

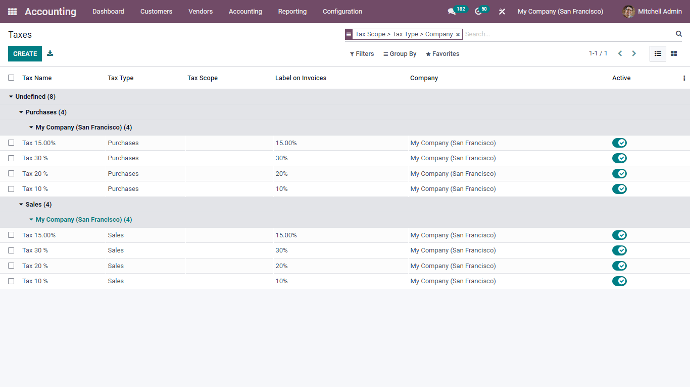

Taxation In Odoo Accounting

Odoo offers various types of taxes across subsidiaries: consumption tax, general sales tax, local taxes, as well as multiple tax schedules for everything from GST to VAT. With a configurable tax engine, Odoo provides an indirect tax management solution, global tax management, generating detailed reports, and analyzing transactions down to line-item tax details in real time.

Odoo's tax engine supports a wide range of tax computations:

price included/excluded, percentage, grid, tax on taxes, partial exemptions, etc.

- Default Taxes

- Fiscal Positions (tax and account mapping)

- Manage withholding taxes

- Manage prices for B2B (tax excluded) and B2C (tax included)

- Manage cash basis taxes

- Manage Fiscal Years Do a year end in Odoo (close a fiscal year)

Tax return

A new tax return feature has been added. It helps with tax deadlines and checks to make sure filings are correct. The feature can also be customized for different regions.

Tax report: tax tag signs

The + and - signs have been removed from tax tags on tax reports; inversions are now handled directly on the report lines.

Taxable supply date

The taxable supply date is enabled in countries where it is needed.

Payment withholding tax

A new tax return feature has been added. It helps with tax deadlines and checks to make sure filings are correct. The feature can also be customized for different regions.

Fiscal categories on accounts

Fiscal categories are now linked to individual accounts. This lets you set different rates for accounts in the same category (for example, fleet expenses in Belgium) without having to create extra categories."

Fiscal Positions

- Tax mappings in fiscal positions have been removed.

- Now, each tax shows which fiscal position it applies to (empty means all) and which taxes it replaces in other positions (for example, a 0% export tax replaces national sales tax in the Export fiscal position).

- Taxes are automatically filtered on invoices based on the fiscal position, and on products based on the Domestic fiscal position.

- Fiscal positions are applied in order, using these filters. Multiple local positions are now simplified into a single Domestic fiscal position.

- On invoices, taxes replaced by others are hidden by default, but you can still find them using "Search More.

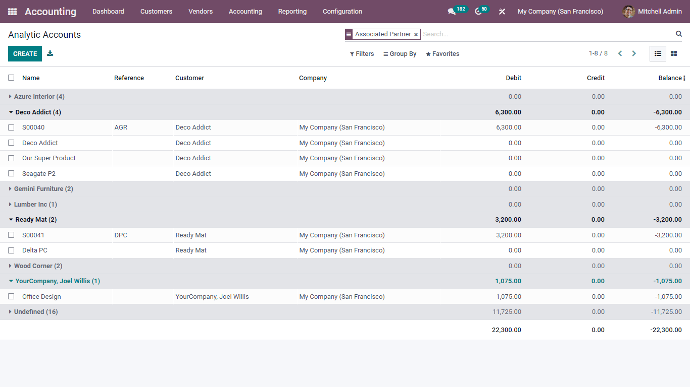

Analytic Of Accounting in Odoo

“Create budgets using analysis dimensions and compare your actual figures with

budgeted figures.”

Generate and analyze reports such as Invoice Analysis,

Analytic Report, Unrealized currency gains and losses, Depreciation module,

Disallowed expenses , Budget analysis, Product margins.

- Get analytic entries based on timesheets, supplier bills

- Automate analytic process (based on project, contracts, department, etc)

- Use of analytic tags and flexible distribution

- Detailed and clear analytic report

- Handle multiple analytic plans

- Clear overview of budget details (start date, end date, budgetary position)

Analytic Budgets In One App Free

Create and track your budgets easily no need to install the Purchase app or worry about committed amounts

Analytic Subplans

It’s now easier to manage the hierarchy of subplans in your budgets and reports.

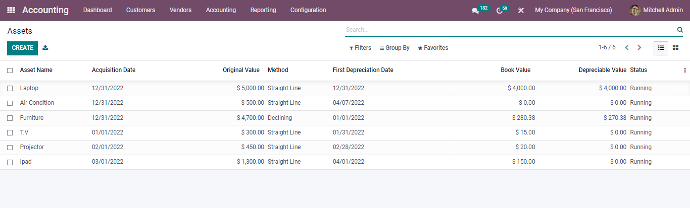

Assets and Revenue Management

“ Handle all assets and revenues in just few clicks "

Manage and control the complete lifecycle of depreciating and non-depreciating assets, from creation to disposal.

Odoo's fixed Assets Management works seamlessly with Procurement & Advanced Financial Management to automate the creation of new assets , posting of depreciation and lease expenses.

Assets Management : • Trace assets , depreciation boards • Generate amortization entries automatically

- Revenue Recognition & Dashboard

- Get all your SaaS metrics in a clear dashboard: MRR, Churn, CAC, CAC ratio, Growth forecasts, ARR, CLT, CLTV.

- Manage multi-year contracts

- Automate Deferred Revenues

- Steadfast dashboard for revenues

- Detailed and clear view of SaaS metrics on clear dashboard

Automation in Odoo Accounting

Recurring Invoices and Payments

Odoo Accounting allows you to automate recurring bills for customers who receive regular billings, such as subscriptions, rent, or maintenance services.

You can schedule an invoice to repeat automatically (weekly, monthly, quarterly, etc.), and Odoo will generate and send it to the customer without your involvement.

Similarly, regular payments can be set up for suppliers or recurring expenses, ensuring you never miss a payment due.

This saves time, increases cash flow consistency, and lowers administrative workload.

A SaaS company can bill clients automatically and accept payments using integrated payment channels like Stripe or PayPal.

Integrating AI and machine learning features.

Odoo is progressively incorporating AI and Machine Learning (ML) to improve automation and accuracy in accounting.

Smart Invoice Recognition: Odoo's AI can scan and extract data from vendor bills or receipts using optical character recognition (OCR). It automatically fills in supplier information, dates, and quantities, avoiding the need for manual data entry.

AI-based reconciliation: Machine learning algorithms use previous reconciliations to recommend the best account matches for future transactions.

Predictive Analytics: AI can estimate cash flow, detect late payments, and identify spending patterns to assist firms in making data-driven financial decisions.

Anomaly Detection: Machine learning can detect unexpected transactions or disparities, thereby preventing fraud or accounting errors.

Automated banking data feeds and reconciling

Odoo interacts directly with banks using automated bank feeds, which means that your bank transactions are integrated into Odoo on a daily basis.

The system automatically compares transactions with their related invoices, payments, or expenses, a process known as bank reconciliation.

Odoo's smart reconciliation tool uses rules and AI-assisted suggestions to assure high accuracy and faster book closing.

Odoo automatically stamps invoices as paid when customers make payments using your bank feed.

Example: Odoo automatically stamps invoices as paid when customers make payments using your bank feed.

Planned Financial Reports

Odoo Accounting automates the preparation and scheduling of financial reports like balance sheets, profit and loss statements, and cash flow reports.

You can set up reports to be generated and emailed to management weekly, monthly, or quarterly.

This ensures that decision-makers always have access to the most recent financial insights, without the need for human preparation.

For example, a corporation can receive a monthly profit and loss report via email on the first of each month.

Other Odoo Services

Odoo Installation

Quick, secure Odoo installation on Dedicated/Public Cloud of On-premise by friendly experts.

Odoo Configuration

Help you to pick up relevant modules of Odoo ERP and configure them to suit your business needs.

Odoo Customization

With unique expertise & combination of best practices, we customize Odoo ERP solutions to meet your business needs with a variety of verticals & business domains.

Odoo Integration

Poweful Odoo integrations that bring business-critical information from heterogeneous enterprise systems to one dashboard.

Odoo Staffing

Make your Odoo implementation a success with right solution, right processes and right staffing.

Odoo Functional Training

Develop ERP skills with functional training and become an invaluable asset for successful digital transformation.

Odoo Technical Training

Develop ERP technical training skills, needed for designing, developing, implementing, maintaining, support.

Odoo Support

Get proactive Odoo support from highly trained, highly motivated experts in ERP implementation.

FAQs About Odoo Accounting

Absolutely. Odoo Accounting supports several currencies and companies, making it ideal for businesses with global subsidiaries or foreign clients.

Yes, it connects smoothly with other Odoo modules such as Sales, Purchase, Inventory, Payroll, and CRM to provide a comprehensive view of all corporate processes.

Odoo can automate many accounting tasks like creating invoices, handling recurring payments, matching bank transactions, and generating reports—saving you time and reducing mistakes.

Odoo Accounting is very customisable. You may tailor workflows, produce bespoke financial reports, and integrate third-party applications to meet your specific business needs.